DES MOINES, Iowa — One of the metro's largest employers is shaking things up.

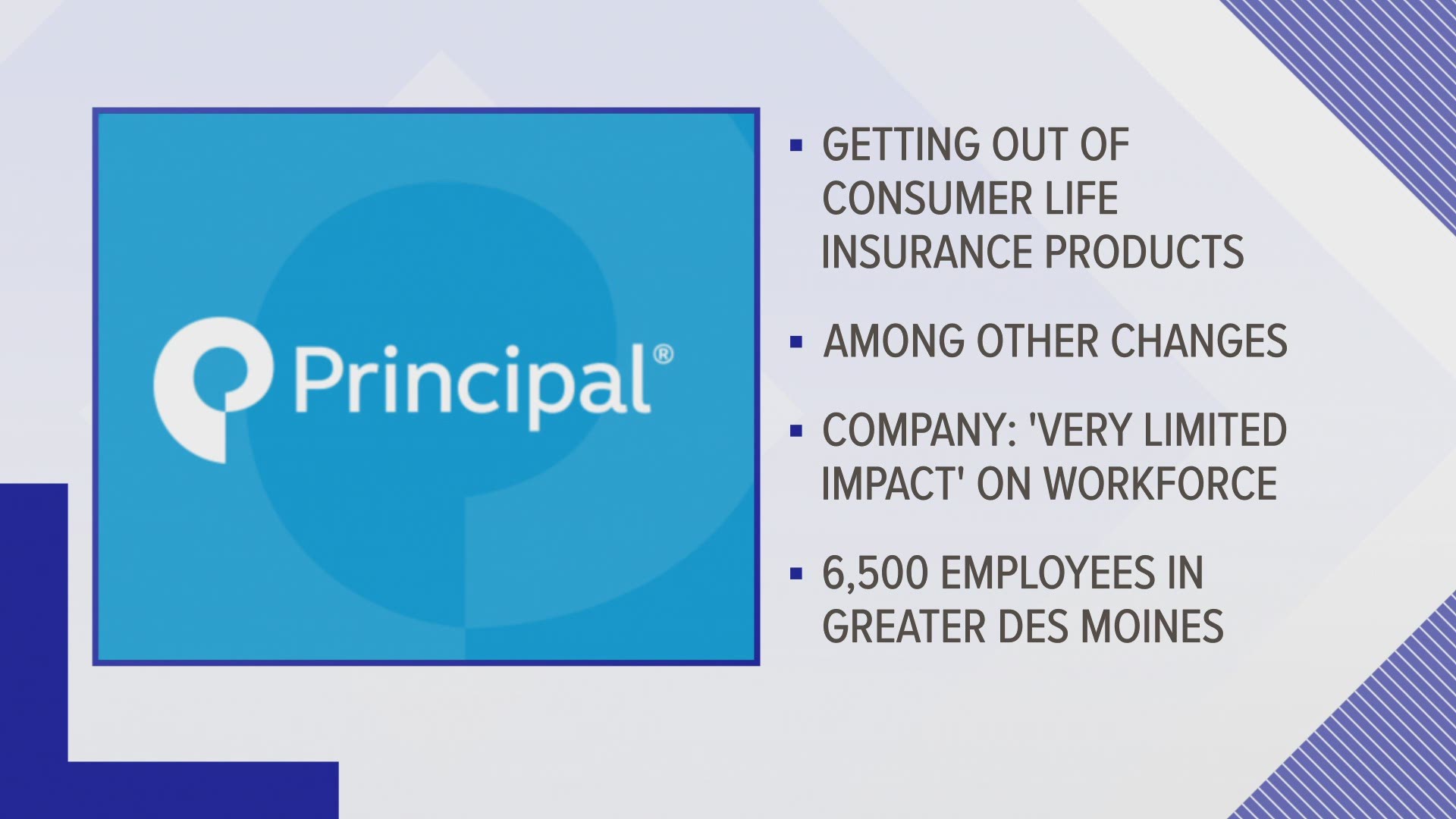

Des Moines-based Principal Financial Group announced changes to their company strategy on Monday, including discontinuing U.S. retail fixed annuities and consumer life insurance products.

Instead, the company will pursue "strategic alternatives, including divestiture, of the related in-force blocks, which have policy reserves of approximately $18 billion."

Individual life insurance policy sales will also be discontinued under this shift. However, Principal Financial will continue to sell variable annuity offerings.

Spokeswoman Jane Slusark said the company is still in the life insurance business. The company is announcing that it will no longer market to the retail segment with individual life products but will continue its "heavy emphasis" on the business market that is a majority of its sales today.

Slusark said there is no impact to any customers of Principal who already have these products. However, the company does expect a "very limited impact" on its workforce based on this announcement.

According to the Greater Des Moines Partnership, the company employed 6,500 residents as of August 2019.

The company is also working to strengthen its capital management strategy. Principal's Board of Directors approved a new authorization to repurchase up to $1.2 billion of the company's outstanding common stock.

"This new authorization is in addition to the approximately $675 million that remains under the company’s prior authorization as of March 31, 2021," says the release. "Principal expects to repurchase between $1.3-$1.7 billion of common shares from March 31, 2021 through the end of 2022 by utilizing capital generated from operations and reducing excess capital to target levels while retiring $300 million of debt maturing in 2022."