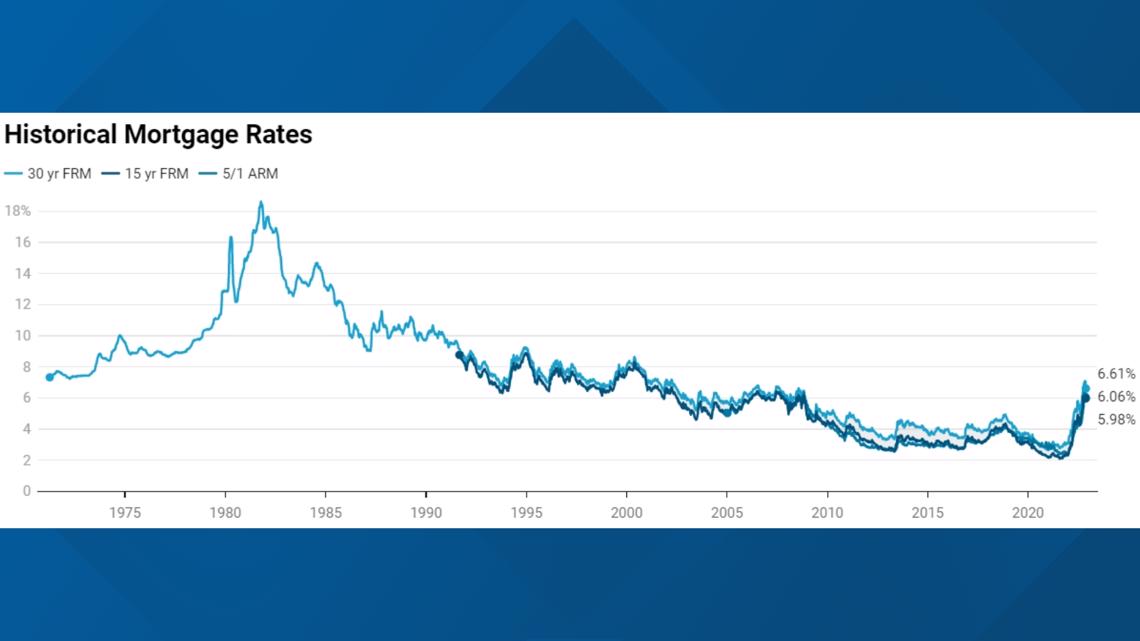

DES MOINES, Iowa — For the vast majority of the past decade, 30-year mortgage interest rates were at levels never seen before. But to fight inflation, the Fed has incrementally increased rates in 2022.

The move has flipped the housing market in Des Moines and around the country.

"Properties are sitting on the market much longer than they were if you backtrack to a year ago. Properties were flying off the market [then]," said Elli Jennings, a realtor with the Jennings Real Estate Team in Ames.

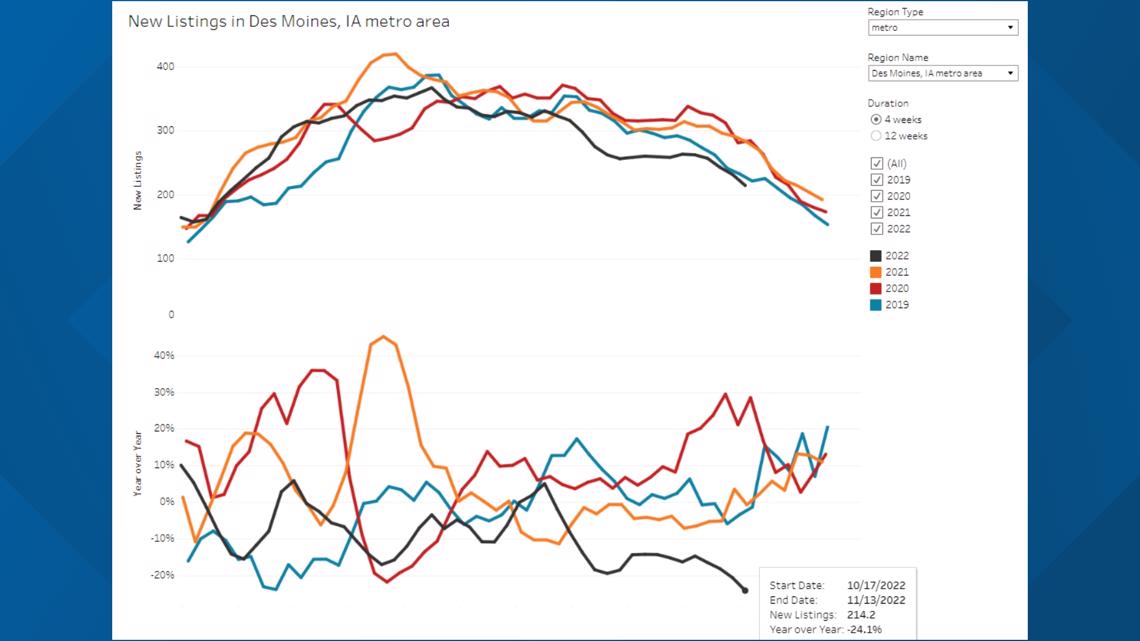

Median prices for new listings haven't necessarily started to fall, but new listings and pending sales have.

"Things really shifted at the beginning of October. Days on market went up, [and] properties were starting to sell under asking. Buyer power is back a little bit," Jennings added.

But no matter what happens with the national housing market seesaw, Des Moines isn't seeing the margin of volatility other large metros do.

"I always say the further you climb up the ladder, the further you fall. We don't have those drastic shifts that other markets do because we don't have the supply, demand, horsepower or population to compare," said Jennings.

Dr. Peter Orazem, an economics professor at Iowa State University, said first time home buyers will likely be impacted the most.

"It's going to become more expensive for them to afford a house, and it's not likely that the housing prices are going to decrease sufficiently to make up for the cost increase in the mortgage rates," Orazem told Local 5 Wednesday.

Even with the stark jump in rates this year, they're still at or below the 50-year average dating back to the 1970s.

Orazem says there is a trend that bears monitoring as we head into 2023.

"If you take out food and take out energy, core inflation really hasn't abated at all. The Fed has a twin mission of keeping employment strong and and keeping the value of the currency stable. When you still see 3.8 million unfilled vacancies a month, I think the Fed is right to be trying to fight inflation because the labor market is nowhere near cooling off yet." Orazem said.

"I don't think that they see unemployment rate rising anytime soon. What they may see is a shortage, [with] fewer unfilled vacancies per month, but there's a big difference between unfilled vacancies and unemployment," he added.