WASHINGTON, D.C., USA — Editor's Note: The video above is from May 11, 2021.

The Internal Revenue Service is warning taxpayers, tax professionals and financial institutions of the "Dirty Dozen" tax schemes and scams to look out for.

The scams are separated into four categories:

- Pandemic-related scams (Economic Impact Payment theft)

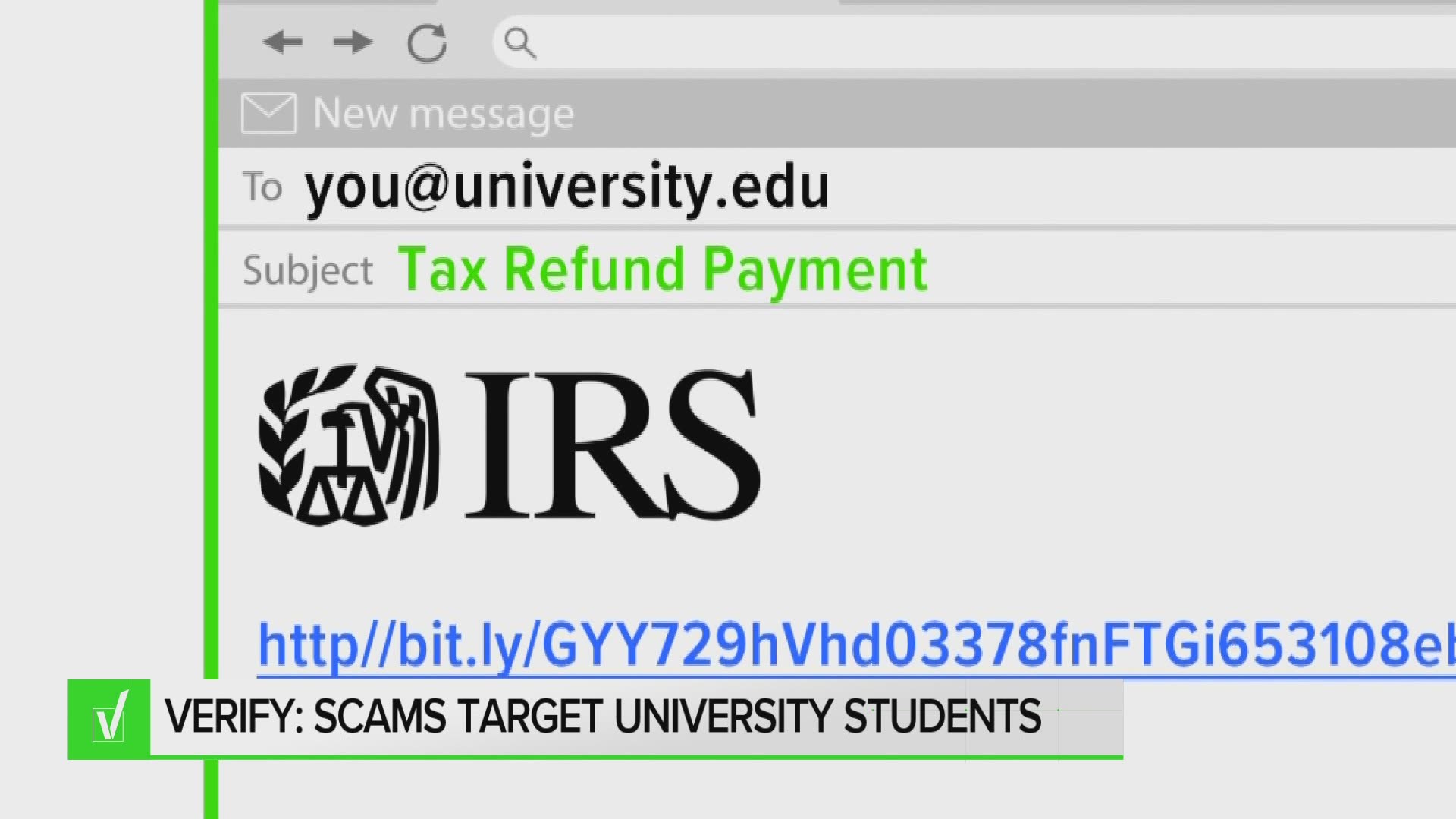

- Personal information cons (phishing, ransomware, "vishing")

- Ruses focusing on unsuspecting victims (fake charities, senior/immigrant fraud)

- Schemes that persuade taxpayers into unscrupulous actions (Offer In Compromise bills and syndicated conservation easements)

The categories are based on the perpetrators of these schemes and who they impact. The IRS urges all taxpayers to be on guard, especially during the pandemic, not just for themselves but for their loved ones.

"We continue to see scam artists use the pandemic to steal money and information from honest taxpayers in a time of crisis," said IRS Commissioner Chuck Rettig. "We provide this list to alert taxpayers about common scams that fraudsters use against their victims. At the IRS, we are dedicated to stopping these criminals, but it’s up to all of us to remain vigilant to protect ourselves and our families."

The full "Dirty Dozen" list can be viewed by clicking/tapping this link.