Congress passed the CARES Act. President Trump signed the legisation.

And now, Iowans are waiting for their stimulus checks in the mail.

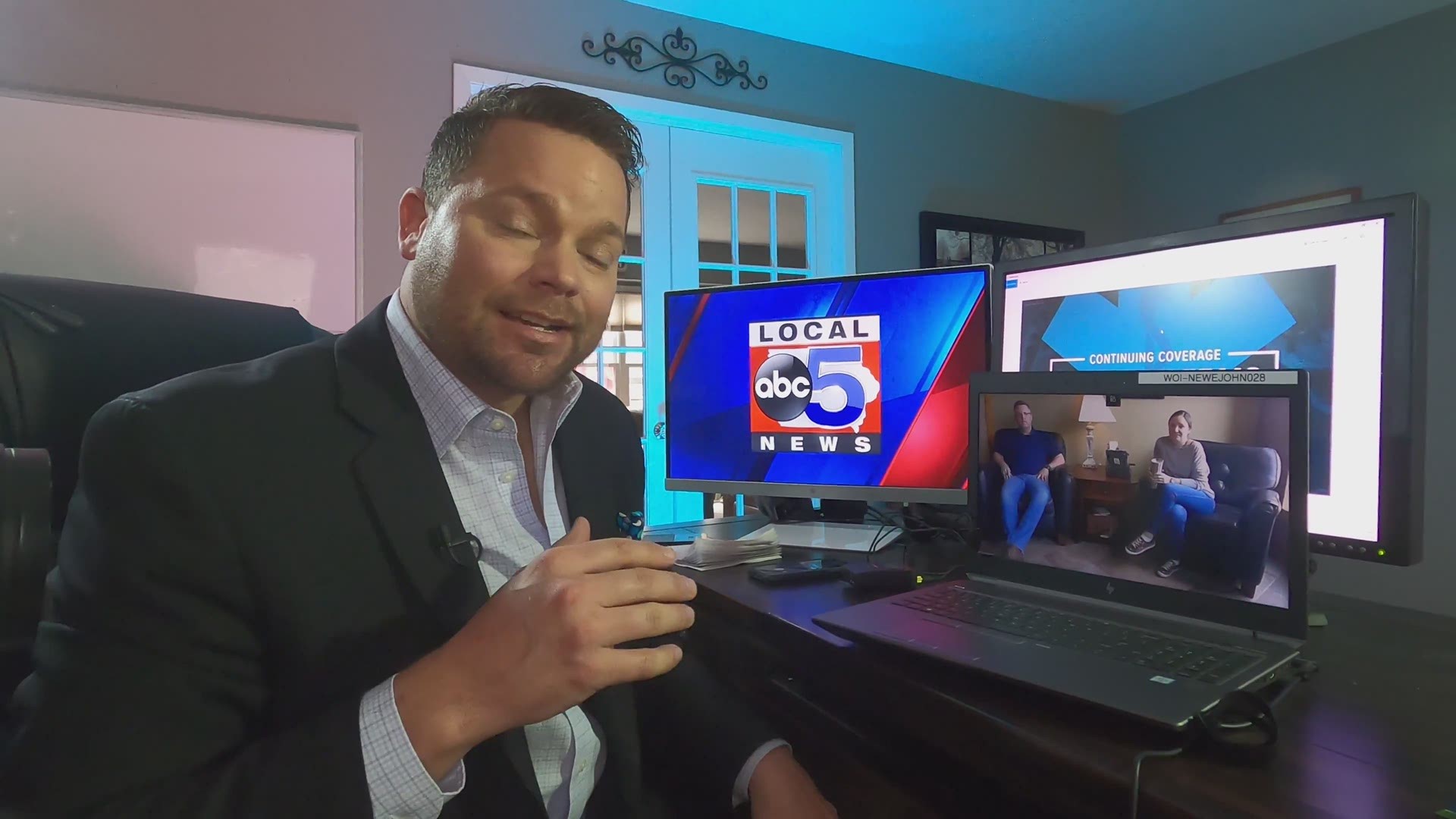

While there is more than just checks being sent out as a relief for Americans due to COVID-19, Local 5's Elias Johnson has what you need to know about how to best spend or save the stimulus money.

Local 5's Elias Johnson spoke to Tim Baker and Lindsey Starrett with Baker Starrett of Grinnell to get some more answers.

Question: What is the most important factor you want people to keep in mind as they receive this stimulus money?

Tim Baker: "Everyone should be getting it within the next one to three weeks in some way beyond what depending on certain circumstances."

Question: Is this taxable income? Are there taxes taken out that check? Do people need to be putting aside money for tax purposes with this money?

Lindsey Starrett: "What we were being told is this is not taxable income, and even if you owe back taxes on something, they should not be withholding it for that purpose. They will hold it back if you owe back child support."

Baker: "I think the biggest thing we want people to know is that no one will be calling you for your bank account number or knocking on your front door asking for banking information. There are a lot of scams going around right now but most everyone should sit back and wait for it to be automatically deposited."

If your direct deposit information is not on file with the Internal Revenue Service, you will receive a check, but it will take longer for that money to get to you.

Another helpful reminder: the IRS will first communicate everything with you via certified mail and never over the phone.