BLOOMINGTON, Minn. — A home invader struck before dawn – attacking a man and his wife while they were still in bed.

Mark Novak and his wife Pam were both brutally beaten and repeatedly stabbed.

Mark died trying to protect his wife.

Pam fought for her life and spent days in intensive care – but survived.

She never imagined she was about to have another fight on her hands – getting State Farm Insurance to cover items, including their blood-soaked bed, damaged in the deadly attack.

The attack – “A lot of blood loss”

“Here’s Mark, always smiling,” Pam said with a smile as she flipped through a photo album.

Mark Novak was her husband of 53 years, a small-town mayor, father and grandfather. She says he was always quick with a compliment – especially for her.

“He loved me. He did. He loved me so much,” she said.

The couple had recently retired and moved back to Bloomington to be near family when, on August 24, 2023, a man broke in and attacked them while they slept.

“I woke up to the beating and being stabbed in the head,” Pam recalled. “We were both, you know, brutally attacked in our beds – and then it moved out into other parts of the house.”

Between assaults, Pam managed to call 911.

“There’s a female whispering ‘help me,’” a police dispatcher told responding officers.

When the police arrived, they found a horrific scene.

“Two victims. Stab wounds,” they reported. “The husband’s upstairs – there’s a lot of blood loss.”

Mark was rushed to a local hospital but was pronounced dead.

Pam spent six days in intensive care with multiple stab wounds and broken bones.

Their townhome was covered in their blood. That included the bed and bedding where the assault began.

“It was brutal,” Pam told KARE 11.

The couple’s nephew Adam Roring was charged with first-degree murder and assault. The motive for the attack is still unclear. Roring is being held on $2-million bond pending a hearing on whether he is competent to stand trial.

“I thought that was part of why you pay insurance”

As Pam recovered – and grieved the murder of her husband – the things she lost were far from her mind.

Besides, she had a State Farm condo owners insurance policy to cover the personal belongings that had been damaged or soaked in blood.

“The bed, the bedding, I mean, you know, the bedframe. I mean everything. I would think that they would cover that,” she told KARE 11. “I thought that was part of why you pay insurance.”

“So, you would assume that State Farm would pay for the bed where your husband was murdered – and you were attacked?” KARE 11 asked.

“Yes, yes,” Pam said.

State Farm saw it differently.

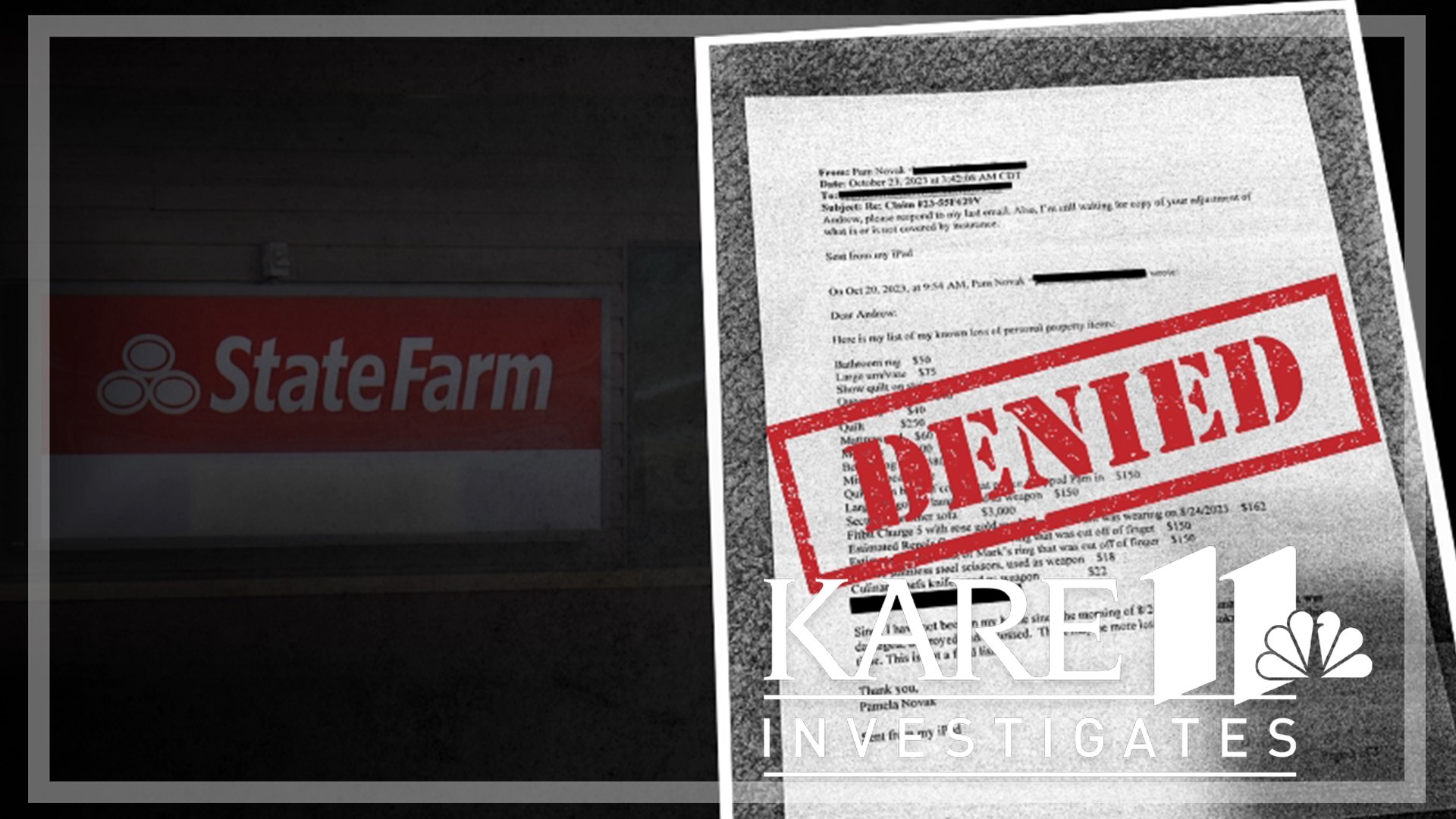

Pam sent the company a list of personal property items damaged in the attack.

But the company denied her claim.

Denied.

State Farm stood by the denial, even after she got a lawyer and appealed.

The reason?

“Personal property damaged by blood is not a named peril,” State Farm wrote in a denial letter.

State Farm agreed to pay just $190 – to cover a broken lamp, scissors and knife, all items listed as used as weapons during the deadly attack.

Pam couldn’t help but think of that inescapable jingle: “Like a good neighbor, State Farm is there.”

“Like a good neighbor?” she asked. “What part of like a ‘good neighbor’ are you for me? And I’m your client.”

An Expert Weighs In

“I felt that the claims processing was unfair,” said Mike Rothman.

Rothman served as Minnesota’s Commerce Commissioner. For six years he headed the agency charged with regulating insurance claims.

KARE 11 asked him to review Pam’s case.

“Personal property damaged by blood is not a named peril,” KARE 11’s Lauren Leamanczyk said, quoting State Farm’s denial letter. “What did you make of that argument?” she asked.

“To say that it doesn’t apply because of blood was, I thought, just completely inappropriate,” Rothman replied.

Rothman says it’s an example of why consumers should appeal improper denials.

“First of all, don’t give up,” Rothman advised consumers. “Pick up the phone, call the Department of Commerce. They have consumer teams to help them.”

He said when he was Commissioner, the department often investigated this type of claim and often the denial was overturned in the customer’s favor.

KARE 11 requested recent data from the state about how often insurance denials are overturned. They told us they don’t track the precise percentage of reversals – but they do monitor the amount of money involved.

Over the past three calendar years, Commerce Department officials estimate they’ve helped consumers who filed complaints saying their property and homeowner’s claims were wrongly denied recover more than $23 million.

In some cases, they say insurance companies reconsidered their denials simply after learning the state was investigating. You can learn more about how to file a complaint online – or by calling the department at 651-539-1600.

State Farm Reverses Course

After interviewing Pam, KARE 11 Investigates reached out to State Farm to request an interview about the case.

The company declined an interview, citing company policy that it “can’t speak to the specifics of any individual customer claim.”

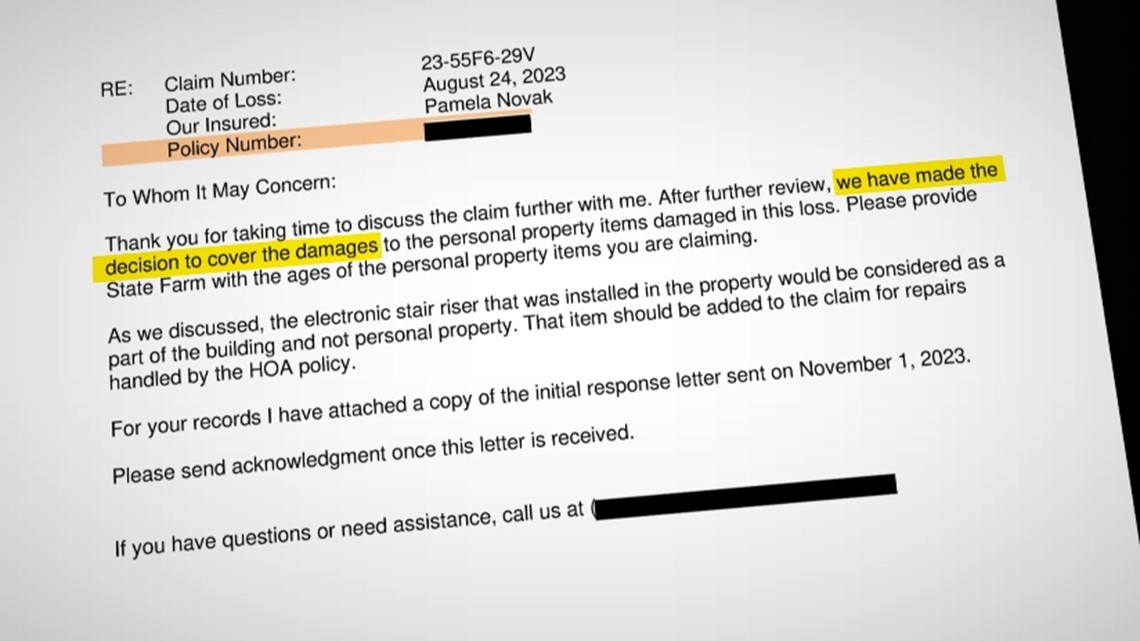

But less than 48 hours after KARE 11 contacted State Farm, the company reversed course.

In a new letter, State Farm wrote: “After further review, we have made the decision to cover the damages …”

Pam fought and won.

“I’ve got fight in me,” she said. “Hey, I’m a survivor.”

But, after losing her husband, she believes it’s a battle she never should have been forced to fight.

“They feel so inhuman – to put anyone through a fight like this.”

A GoFundMe account has been established to help Pam in her recovery. You can learn more information at: https://www.gofundme.com/f/Mark-Pam-Novak

MORE FROM KARE 11 INVESTIGATES:

Watch more KARE 11 Investigates:

Watch all of the latest stories from our award-winning investigative team in our special YouTube playlist: