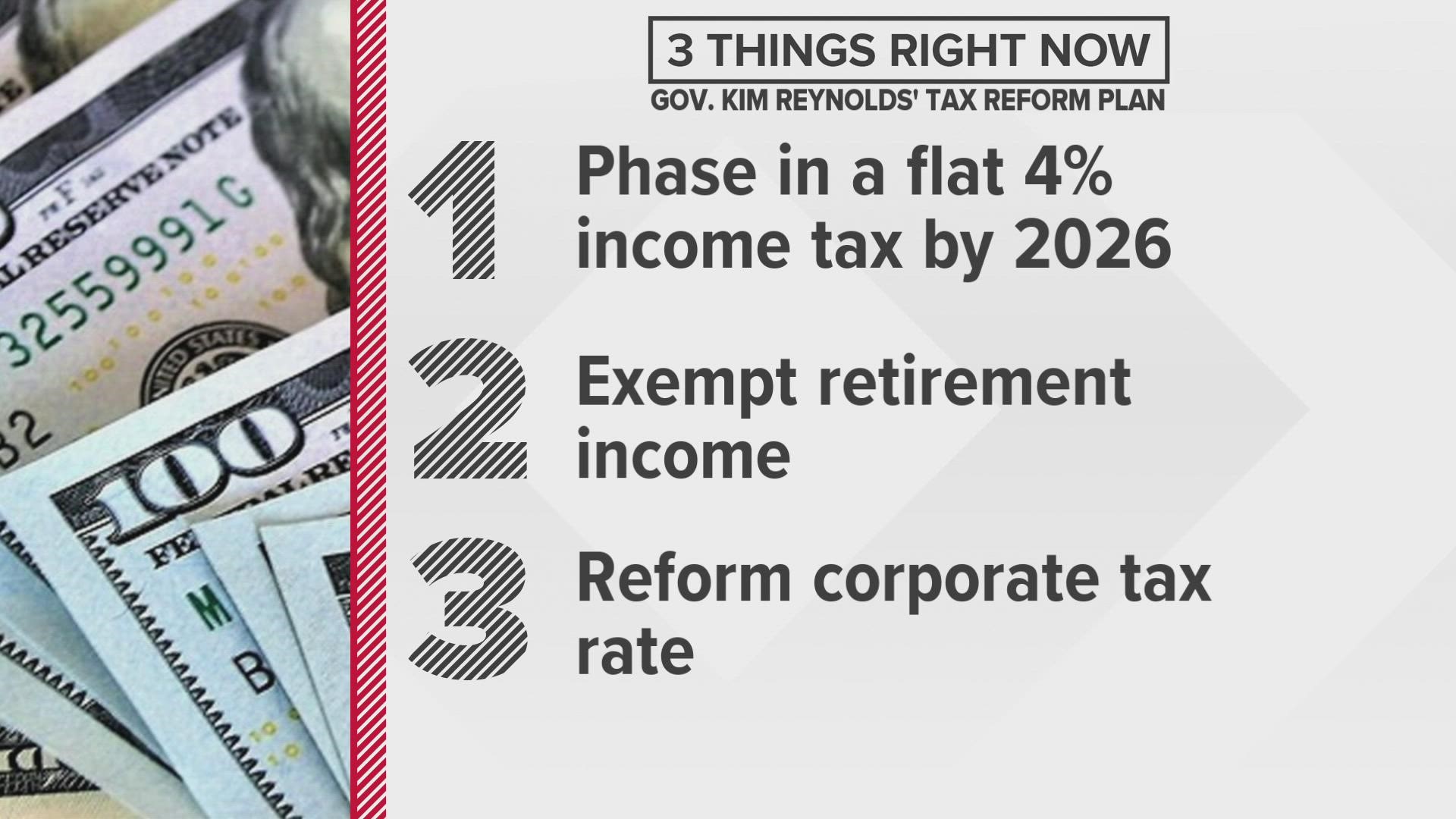

DES MOINES, Iowa — After proposing a flat income tax rate and the elimination of retirement taxes in her Condition of the State speech, Gov. Kim Reynolds detailed her plan for a range of cuts at a press conference Tuesday.

While Republicans in the House and Senate are also pushing for tax cuts, there are some discrepancies in the details.

Reynolds' plan would set the individual income tax at a flat 4% rate by 2026, which House Republicans also support. The Senate plan sets a flat rate of 3.6% by 2027.

"This historic tax cut will benefit every taxpayer, and turbocharge widespread, broad-based prosperity in our state, and most importantly, it rewards hard work," Reynolds said.

Her plan would also exempt Iowans 55 and older from state retirement income taxes beginning in 2023, which both the House and Senate proposals also support.

Reynolds also proposed a system that would eventually set the top corporate tax rate to a flat 5.5%. The Senate plan calls for a flat 7.8% corporate rate, while the House plan does not include corporate tax cuts.

"I think it sends a clear message to the rest of the country that Iowa is open for business," Reynolds said.

House Minority Leader Jennifer Konfrst (D-Windsor Heights) said the plan to give tax cuts to corporations is "just wrong."

“Corporations, special interests, and millionaires don’t need another huge tax break," Konfrst said. "We need a fair tax system for every day Iowans that rewards hard work and puts more money in the pockets of working families.”

WATCH | Breaking down tax reform proposals and an update on the state's Afghan refugees: This Week in Iowa