DES MOINES, Iowa — More than 58,000 Iowans field for unemployment in the past week due to COVID-19 layoffs, according to the latest numbers from Iowa Workforce Development. The number is part of the more than 6.6 million Americans who applied for unemployment benefits last week — doubling a record high set just one week earlier — a sign that layoffs are accelerating in the midst of the coronavirus.

There were 55,963 initial claims by individuals who work and live in Iowa, and 2,490 claims by individuals who work in Iowa and live out of state. A total of $13,724,985.87 of unemployment insurance benefits were paid to claimants who live and/or work in Iowa for the week ending on March 27. It may be several weeks until many of the payments are made, however.

The following industry breakdown includes all (COVID-19 & non-COVID-19) claimants counts for last week, knowing a majority of them are going to be COVID-19-related. This will be reflective of the other data included in the release:

- Accommodation and Food Services (12,519)

- Health Care and Social Assistance (7,490)

- Manufacturing (7,168)

- Retail Trade (5,888)

- Other Services (3,780)

Applications for unemployment benefits generally reflect the pace of layoffs.

Combined with last week's report that 3.3 million people sought unemployment aid two weeks ago, the U.S. economy has now suffered nearly 10 million layoffs in just the past several weeks — far exceeding the figure for any corresponding period on record.

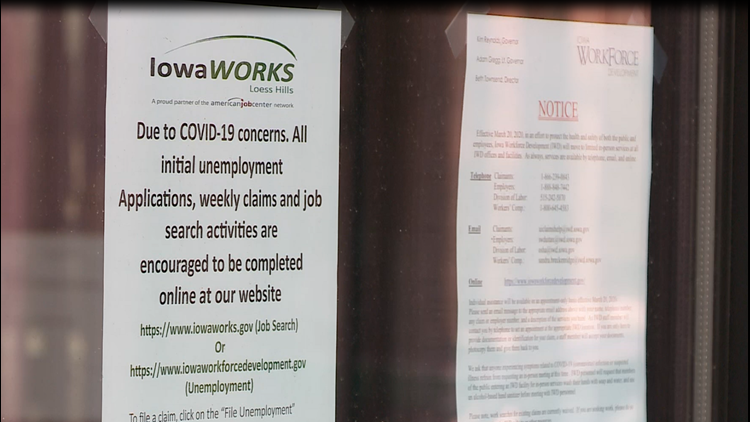

Iowa Workforce Development has been hosting webinars to inform Iowans how to file a claim and how to get answers. It also is assessing the impact of the newly-signed CARES Act.

Wait times for Iowans seeking to file for unemployment benefits have been longer than usual, and the state agency admits this on its website.

The accelerating layoffs have led many economists to envision as many as 20 million lost jobs by the end of April. That would be more than double the 8.7 million jobs lost during the Great Recession. The unemployment rate could spike to as high as 15% this month, above the previous record of 10.8% set during a deep recession in 1982.

Many employers are slashing their payrolls to try to stay afloat because their revenue has collapsed, especially at restaurants, hotels, gyms, movie theaters and other venues that depend on face-to-face interaction. Auto sales have sunk, and factories have closed.

More than two-thirds of the U.S. population are under stay-at-home orders, imposed by most U.S. states. That has intensified pressure on businesses, most of which face rent, loans and other bills that must be paid.